ABOUT ME

ABOUT ME

ABOUT ME

EXPERIENCE & IMPACT

EXPERIENCE & IMPACT

EXPERIENCE & IMPACT

MEDIA

MEDIA

MEDIA

EN/ES

EN/ES

EN/ES

Giving women the financial power to choose

freedom over fear.

freedom over fear.

Giving women the financial power to choose freedom over fear.

Giving women the financial power to choose freedom over fear.

Discover how my story connects to financial justice

Discover how my story connects to financial justice

Discover how my story connects to financial justice

Why

Why

Why

Across Latin America, millions of women remain outside financial and digital systems that were never designed with their realities in mind. The work of expanding economic autonomy begins by reimagining how law, finance, technology, and feminist imagination can come together to create systems that include, protect, and empower.

Alongside partners in regulation, fintech, and community organizing, we redesign financial tools, policies, and digital infrastructures so they finally serve the women long excluded from them: rural and Indigenous communities, caregivers, workers, students, and entrepreneurs. This is how financial inclusion becomes more than access; it becomes safety, opportunity, and lasting systemic change.

Across Latin America, millions of women remain outside financial and digital systems that were never designed with their realities in mind. The work of expanding economic autonomy begins by reimagining how law, finance, technology, and feminist imagination can come together to create systems that include, protect, and empower.

Alongside partners in regulation, fintech, and community organizing, we redesign financial tools, policies, and digital infrastructures so they finally serve the women long excluded from them: rural and Indigenous communities, caregivers, workers, students, and entrepreneurs. This is how financial inclusion becomes more than access; it becomes safety, opportunity, and lasting systemic change.

Across Latin America, millions of women remain outside financial and digital systems that were never designed with their realities in mind. The work of expanding economic autonomy begins by reimagining how law, finance, technology, and feminist imagination can come together to create systems that include, protect, and empower.

Alongside partners in regulation, fintech, and community organizing, we redesign financial tools, policies, and digital infrastructures so they finally serve the women long excluded from them: rural and Indigenous communities, caregivers, workers, students, and entrepreneurs. This is how financial inclusion becomes more than access; it becomes safety, opportunity, and lasting systemic change.

About Me

About Me

About Me

My work lives at the intersection of law, finance, technology, and feminist imagination.

I was trained as a lawyer, shaped by public service, and sharpened in the financial sector. My purpose, however, took form by observing who our systems protect—and who they quietly exclude.

Financial inclusion revealed itself as a structural challenge: regulations that overlook women, products not designed for care or informality, and digital gaps that limit participation. I have also seen the inverse. When systems change, access becomes agency, and autonomy becomes power.

Today, I build legal, financial, digital, and community-driven pathways alongside women across communities and life stages, designing education, tools, and policy proposals rooted in care and accountability.

I know technology and regulation can be redesigned to expand freedom.

Economic autonomy doesn’t ask for permission—we create it.

My work lives at the intersection of law, finance, technology, and feminist imagination.

I was trained as a lawyer, shaped by public service, and sharpened in the financial sector. My purpose, however, took form by observing who our systems protect—and who they quietly exclude.

Financial inclusion revealed itself as a structural challenge: regulations that overlook women, products not designed for care or informality, and digital gaps that limit participation. I have also seen the inverse. When systems change, access becomes agency, and autonomy becomes power.

Today, I build legal, financial, digital, and community-driven pathways alongside women across communities and life stages, designing education, tools, and policy proposals rooted in care and accountability.

I know technology and regulation can be redesigned to expand freedom.

Economic autonomy doesn’t ask for permission—we create it.

My work lives at the intersection of law, finance, technology, and feminist imagination.

I was trained as a lawyer, shaped by public service, and sharpened in the financial sector. My purpose, however, took form by observing who our systems protect—and who they quietly exclude.

Financial inclusion revealed itself as a structural challenge: regulations that overlook women, products not designed for care or informality, and digital gaps that limit participation. I have also seen the inverse. When systems change, access becomes agency, and autonomy becomes power.

Today, I build legal, financial, digital, and community-driven pathways alongside women across communities and life stages, designing education, tools, and policy proposals rooted in care and accountability.

I know technology and regulation can be redesigned to expand freedom.

Economic autonomy doesn’t ask for permission—we create it.

Experience & Impact

Experience & Impact

Experience & Impact

I design legal, financial, and technological solutions that expand economic dignity and digital access for women in Mexico and Latin America.

I design legal, financial, and technological solutions that expand economic dignity and digital access for women in Mexico and Latin America.

Quantiica Global Solutions — Head of Legal and Compliance

Quantiica Global Solutions — Head of Legal and Compliance

Quantiica Global Solutions — Head of Legal and Compliance

Designing compliance-by-design software for safer, more inclusive finance.

At Quantiica, I collaborate in the design of regulatory-technology software that simplifies financial compliance and improves how financial products are built and supervised.

I translate financial regulation, data protection, and cybersecurity requirements into product logic and onboarding workflows, embedding compliance directly into system architecture.

My work supports a financial market capable of delivering tools that are easier to use, more secure, and accessible to more diverse users—without compromising regulatory integrity or trust.

Designing compliance-by-design software for safer, more inclusive finance.

At Quantiica, I collaborate in the design of regulatory-technology software that simplifies financial compliance and improves how financial products are built and supervised.

I translate financial regulation, data protection, and cybersecurity requirements into product logic and onboarding workflows, embedding compliance directly into system architecture.

My work supports a financial market capable of delivering tools that are easier to use, more secure, and accessible to more diverse users—without compromising regulatory integrity or trust.

Designing compliance-by-design software for safer, more inclusive finance.

At Quantiica, I collaborate in the design of regulatory-technology software that simplifies financial compliance and improves how financial products are built and supervised.

I translate financial regulation, data protection, and cybersecurity requirements into product logic and onboarding workflows, embedding compliance directly into system architecture.

My work supports a financial market capable of delivering tools that are easier to use, more secure, and accessible to more diverse users—without compromising regulatory integrity or trust.

VIT by Vector® — Lead Counsel, Fintech & AI Governance

VIT by Vector® — Lead Counsel, Fintech & AI Governance

VIT by Vector® — Lead Counsel, Fintech & AI Governance

Building regulatory infrastructure for AI-driven financial inclusion.

Building regulatory infrastructure for AI-driven financial inclusion.

Building regulatory infrastructure for AI-driven financial inclusion.

As the senior legal architect behind VIT, a project that intended to be one of Mexico’s first fully digital, AI-powered investment platforms, I shaped the regulatory, compliance, and governance frameworks that enabled a traditionally exclusive investment ecosystem to open to new users.

I advised on algorithmic decision-making, risk mitigation, consumer protection, and digital onboarding design, ensuring that innovation aligned with regulatory integrity and inclusion goals.

This work positioned me at the intersection of AI ethics, financial regulation, and user-centered product design, giving me a sophisticated understanding of how technology can democratize investing when deployed with accountability and rigor.

As the senior legal architect behind VIT, a project that intended to be one of Mexico’s first fully digital, AI-powered investment platforms, I shaped the regulatory, compliance, and governance frameworks that enabled a traditionally exclusive investment ecosystem to open to new users.

I advised on algorithmic decision-making, risk mitigation, consumer protection, and digital onboarding design, ensuring that innovation aligned with regulatory integrity and inclusion goals.

This work positioned me at the intersection of AI ethics, financial regulation, and user-centered product design, giving me a sophisticated understanding of how technology can democratize investing when deployed with accountability and rigor.

As the senior legal architect behind VIT, a project that intended to be one of Mexico’s first fully digital, AI-powered investment platforms, I shaped the regulatory, compliance, and governance frameworks that enabled a traditionally exclusive investment ecosystem to open to new users.

I advised on algorithmic decision-making, risk mitigation, consumer protection, and digital onboarding design, ensuring that innovation aligned with regulatory integrity and inclusion goals.

This work positioned me at the intersection of AI ethics, financial regulation, and user-centered product design, giving me a sophisticated understanding of how technology can democratize investing when deployed with accountability and rigor.

VIT by Vector® — Lead Counsel, Fintech & AI Governance

VIT by Vector® — Lead Counsel, Fintech & AI Governance

VIT by Vector® — Lead Counsel, Fintech & AI Governance

Building regulatory infrastructure for AI-driven financial inclusion.

Building regulatory infrastructure for AI-driven financial inclusion.

Building regulatory infrastructure for AI-driven financial inclusion.

As the senior legal architect behind VIT, a project that intended to be one of Mexico’s first fully digital, AI-powered investment platforms, I shaped the regulatory, compliance, and governance frameworks that enabled a traditionally exclusive investment ecosystem to open to new users.

I advised on algorithmic decision-making, risk mitigation, consumer protection, and digital onboarding design, ensuring that innovation aligned with regulatory integrity and inclusion goals.

This work positioned me at the intersection of AI ethics, financial regulation, and user-centered product design, giving me a sophisticated understanding of how technology can democratize investing when deployed with accountability and rigor.

As the senior legal architect behind VIT, a project that intended to be one of Mexico’s first fully digital, AI-powered investment platforms, I shaped the regulatory, compliance, and governance frameworks that enabled a traditionally exclusive investment ecosystem to open to new users.

I advised on algorithmic decision-making, risk mitigation, consumer protection, and digital onboarding design, ensuring that innovation aligned with regulatory integrity and inclusion goals.

This work positioned me at the intersection of AI ethics, financial regulation, and user-centered product design, giving me a sophisticated understanding of how technology can democratize investing when deployed with accountability and rigor.

As the senior legal architect behind VIT, a project that intended to be one of Mexico’s first fully digital, AI-powered investment platforms, I shaped the regulatory, compliance, and governance frameworks that enabled a traditionally exclusive investment ecosystem to open to new users.

I advised on algorithmic decision-making, risk mitigation, consumer protection, and digital onboarding design, ensuring that innovation aligned with regulatory integrity and inclusion goals.

This work positioned me at the intersection of AI ethics, financial regulation, and user-centered product design, giving me a sophisticated understanding of how technology can democratize investing when deployed with accountability and rigor.

Oplay® Digital Services — Lead Counsel, Inclusive Credit Innovation

Oplay® Digital Services — Lead Counsel, Inclusive Credit Innovation

Oplay® Digital Services — Lead Counsel, Inclusive Credit Innovation

Designing gender-intelligent credit products at scale.

Designing gender-intelligent credit products at scale.

Designing gender-intelligent credit products at scale.

At Oplay, I served as the legal lead for Aliada Digital, a credit solution intentionally engineered for women, combining financial access with legal, psychological, and medical support services.

Here, I developed a nuanced expertise in gender-responsive product regulation, understanding how credit design intersects with income volatility, caregiving responsibilities, digital literacy, and safety dynamics.

This role deepened my conviction that financial inclusion is not simply about access, it requires systems that protect, empower, and adapt to women’s lived realities.

At Oplay, I served as the legal lead for Aliada Digital, a credit solution intentionally engineered for women, combining financial access with legal, psychological, and medical support services.

Here, I developed a nuanced expertise in gender-responsive product regulation, understanding how credit design intersects with income volatility, caregiving responsibilities, digital literacy, and safety dynamics.

This role deepened my conviction that financial inclusion is not simply about access, it requires systems that protect, empower, and adapt to women’s lived realities.

At Oplay, I served as the legal lead for Aliada Digital, a credit solution intentionally engineered for women, combining financial access with legal, psychological, and medical support services.

Here, I developed a nuanced expertise in gender-responsive product regulation, understanding how credit design intersects with income volatility, caregiving responsibilities, digital literacy, and safety dynamics.

This role deepened my conviction that financial inclusion is not simply about access, it requires systems that protect, empower, and adapt to women’s lived realities.

National Banking and Securities Commission (CNBV)

— Regulatory Litigation & Enforcement

National Banking and Securities Commission (CNBV)

— Regulatory Litigation & Enforcement

National Banking and Securities Commission (CNBV)

— Regulatory Litigation & Enforcement

Defending the integrity of Mexico’s financial system.

Defending the integrity of Mexico’s financial system.

Defending the integrity of Mexico’s financial system.

At the CNBV, I led high-impact enforcement and litigation processes that upheld the authority of the regulator and safeguarded consumers. I managed sanctions, authorizations revocations, state-liability cases, and criminal-liability assessments in coordination with federal authorities.

This experience gave me a rare, systemic command of how financial rules are created, challenged, and enforced, and how regulatory frameworks can either perpetuate or dismantle structural inequities. It is the institutional foundation that now informs my work in inclusive fintech and policy innovation.

At the CNBV, I led high-impact enforcement and litigation processes that upheld the authority of the regulator and safeguarded consumers. I managed sanctions, authorizations revocations, state-liability cases, and criminal-liability assessments in coordination with federal authorities.

This experience gave me a rare, systemic command of how financial rules are created, challenged, and enforced, and how regulatory frameworks can either perpetuate or dismantle structural inequities. It is the institutional foundation that now informs my work in inclusive fintech and policy innovation.

At the CNBV, I led high-impact enforcement and litigation processes that upheld the authority of the regulator and safeguarded consumers. I managed sanctions, authorizations revocations, state-liability cases, and criminal-liability assessments in coordination with federal authorities.

This experience gave me a rare, systemic command of how financial rules are created, challenged, and enforced, and how regulatory frameworks can either perpetuate or dismantle structural inequities. It is the institutional foundation that now informs my work in inclusive fintech and policy innovation.

Designing Feminist Financial Systems that expand economic autonomy for women.

Designing Feminist Financial Systems that expand economic autonomy for women.

Designing Feminist Financial Systems that expand economic autonomy for women.

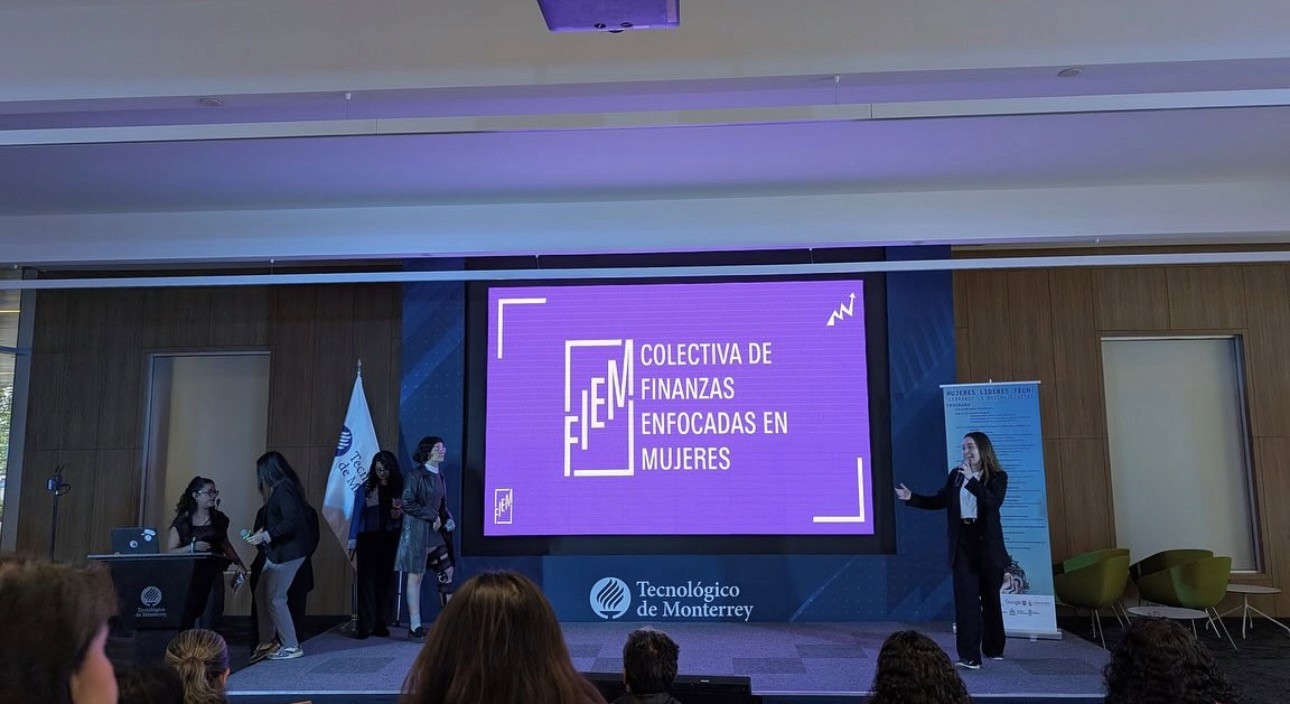

FIEM Colectiva de Finanzas Enfocadas en Mujeres.

FIEM Colectiva de Finanzas Enfocadas en Mujeres.

FIEM Colectiva de Finanzas Enfocadas en Mujeres.

Co-founder & General Director.

Co-founder & General Director.

Co-founder & General Director.

I cofounded Colectiva de Finanzas Enfocadas en Mujeres (FIEM) to transform how women in Mexico access, understand, and use financial and labor systems. FIEM operates as a feminist economic collective, a policy voice, and a grassroots laboratory that creates tools, education, and community infrastructures for economic autonomy.

I cofounded Colectiva de Finanzas Enfocadas en Mujeres (FIEM) to transform how women in Mexico access, understand, and use financial and labor systems. FIEM operates as a feminist economic collective, a policy voice, and a grassroots laboratory that creates tools, education, and community infrastructures for economic autonomy.

I cofounded Colectiva de Finanzas Enfocadas en Mujeres (FIEM) to transform how women in Mexico access, understand, and use financial and labor systems. FIEM operates as a feminist economic collective, a policy voice, and a grassroots laboratory that creates tools, education, and community infrastructures for economic autonomy.

Visit: www.colectivafiem.org

Visit: www.colectivafiem.org

Strategic Impact & Milestones

Strategic Impact & Milestones

Strategic Impact & Milestones

MARCH 2023

MARCH 2023

MARCH 2023

First financial-rights contingent in Mexico’s 8M march

First financial-rights contingent in Mexico’s 8M march

First financial-rights contingent in Mexico’s 8M march

FIEM became the first collective to bring financial and labor rights into the Women’s Day march, reframing economic autonomy as a pillar of feminist struggle. Our collective has now turned into the annual leader of the feminist financial inclusion contingent.

FIEM became the first collective to bring financial and labor rights into the Women’s Day march, reframing economic autonomy as a pillar of feminist struggle. Our collective has now turned into the annual leader of the feminist financial inclusion contingent.

FIEM became the first collective to bring financial and labor rights into the Women’s Day march, reframing economic autonomy as a pillar of feminist struggle. Our collective has now turned into the annual leader of the feminist financial inclusion contingent.

2024

2024

2024

Feminist Economics Reading Circle

(100+ women across 5 states)

Feminist Economics Reading Circle

(100+ women across 5 states)

Feminist Economics Reading Circle

(100+ women across 5 states)

We designed and hosted FIEM’s first reading circle, building a national community of women exploring feminist economics, care economies, and digital inclusion. The circle functioned as a civic education space and a pipeline for economic empowerment and has now turned into an annual reading group.

We designed and hosted FIEM’s first reading circle, building a national community of women exploring feminist economics, care economies, and digital inclusion. The circle functioned as a civic education space and a pipeline for economic empowerment and has now turned into an annual reading group.

We designed and hosted FIEM’s first reading circle, building a national community of women exploring feminist economics, care economies, and digital inclusion. The circle functioned as a civic education space and a pipeline for economic empowerment and has now turned into an annual reading group.

JUNE 2024

JUNE 2024

JUNE 2024

National Citizen Security Agenda of the Supreme Court of Justice

National Citizen Security Agenda of the Supreme Court of Justice

National Citizen Security Agenda of the Supreme Court of Justice

FIEM served as moderators for the working groups for female victims and female judges in one of Mexico’s largest participatory justice initiatives. We elevated women’s economic and labor-rights perspectives within national security discussions.

FIEM served as moderators for the working groups for female victims and female judges in one of Mexico’s largest participatory justice initiatives. We elevated women’s economic and labor-rights perspectives within national security discussions.

FIEM served as moderators for the working groups for female victims and female judges in one of Mexico’s largest participatory justice initiatives. We elevated women’s economic and labor-rights perspectives within national security discussions.

OCTOBER 2024

OCTOBER 2024

OCTOBER 2024

Financial education for caregivers of children with cerebral palsy

Financial education for caregivers of children with cerebral palsy

Financial education for caregivers of children with cerebral palsy

In partnership with Instituto Nuevo Amanecer, we created specialized personal-finance workshops for mothers facing extreme labor precarity, illustrating how financial tools can strengthen caregiving economies.

In partnership with Instituto Nuevo Amanecer, we created specialized personal-finance workshops for mothers facing extreme labor precarity, illustrating how financial tools can strengthen caregiving economies.

In partnership with Instituto Nuevo Amanecer, we created specialized personal-finance workshops for mothers facing extreme labor precarity, illustrating how financial tools can strengthen caregiving economies.

JANUARY 2024

JANUARY 2024

JANUARY 2024

FIEM becomes a registered civil society organization

FIEM becomes a registered civil society organization

FIEM becomes a registered civil society organization

We formalized FIEM as a non-profit entity to scale our impact, allowing us to hire staff, contract professional services, and receive donations for mission-aligned projects.

We formalized FIEM as a non-profit entity to scale our impact, allowing us to hire staff, contract professional services, and receive donations for mission-aligned projects.

We formalized FIEM as a non-profit entity to scale our impact, allowing us to hire staff, contract professional services, and receive donations for mission-aligned projects.

2025 (ONGOING)

2025 (ONGOING)

2025 (ONGOING)

Financial education for people in social reintegration

Financial education for people in social reintegration

Financial education for people in social reintegration

We have developed the first financial inclusion program for individuals exiting penitentiary centers addressing one of the least-served and most economically vulnerable populations in Mexico.

We have developed the first financial inclusion program for individuals exiting penitentiary centers addressing one of the least-served and most economically vulnerable populations in Mexico.

We have developed the first financial inclusion program for individuals exiting penitentiary centers addressing one of the least-served and most economically vulnerable populations in Mexico.

*

*

*

FIEM as a Feminist Financial-Inclusion Lab

FIEM as a Feminist Financial-Inclusion Lab

FIEM as a Feminist Financial-Inclusion Lab

*

*

*

Across our projects, FIEM combines grassroots pedagogy, regulatory insight, and technological tools to redesign economic systems from the perspective of women who have historically been excluded.

Under my leadership, the collective has become a space where policy, community practice, digital innovation, and feminist economics converge to expand women’s decision-making power, safety, and economic dignity.

Across our projects, FIEM combines grassroots pedagogy, regulatory insight, and technological tools to redesign economic systems from the perspective of women who have historically been excluded.

Under my leadership, the collective has become a space where policy, community practice, digital innovation, and feminist economics converge to expand women’s decision-making power, safety, and economic dignity.

Across our projects, FIEM combines grassroots pedagogy, regulatory insight, and technological tools to redesign economic systems from the perspective of women who have historically been excluded.

Under my leadership, the collective has become a space where policy, community practice, digital innovation, and feminist economics converge to expand women’s decision-making power, safety, and economic dignity.

Paréntesis Legal (2025) — Columnist

Paréntesis Legal (2025) — Columnist

Paréntesis Legal (2025) — Columnist

https://parentesislegal.com/barbara-espinosa-lizcano/

https://parentesislegal.com/barbara-espinosa-lizcano/

https://parentesislegal.com/barbara-espinosa-lizcano/

“El Derecho se divorció de las Finanzas y todas quedamos huérfanas: las consecuencias de abogar sin perspectiva financiera”

A critical essay on why legal practice cannot serve women without integrating financial systems analysis.

”Entre la norma y la realidad: vigencia material del artículo 1º constitucional ante la inequidad laboral y salarial que enfrentan las mujeres en México”

“El Derecho se divorció de las Finanzas y todas quedamos huérfanas: las consecuencias de abogar sin perspectiva financiera”

A critical essay on why legal practice cannot serve women without integrating financial systems analysis.

”Entre la norma y la realidad: vigencia material del artículo 1º constitucional ante la inequidad laboral y salarial que enfrentan las mujeres en México”

“El Derecho se divorció de las Finanzas y todas quedamos huérfanas: las consecuencias de abogar sin perspectiva financiera”

A critical essay on why legal practice cannot serve women without integrating financial systems analysis.

”Entre la norma y la realidad: vigencia material del artículo 1º constitucional ante la inequidad laboral y salarial que enfrentan las mujeres en México”

An article that examines the gap between the constitutional mandate of non-discrimination and the reality of the gender wage gap, showing how Article 1 operates as a legally valid provision yet remains insufficient in its effective implementation.

An article that examines the gap between the constitutional mandate of non-discrimination and the reality of the gender wage gap, showing how Article 1 operates as a legally valid provision yet remains insufficient in its effective implementation.

An article that examines the gap between the constitutional mandate of non-discrimination and the reality of the gender wage gap, showing how Article 1 operates as a legally valid provision yet remains insufficient in its effective implementation.

La Cadera de Eva, La Silla Rota (2025) — Columnist

La Cadera de Eva, La Silla Rota (2025) — Columnist

La Cadera de Eva, La Silla Rota (2025) — Columnist

“Todo código tiene ideología: urge diversidad digital”A deep dive into algorithmic bias, feminist digital rights, and the need for inclusive tech design.

“Todo código tiene ideología: urge diversidad digital”A deep dive into algorithmic bias, feminist digital rights, and the need for inclusive tech design.

“Todo código tiene ideología: urge diversidad digital”A deep dive into algorithmic bias, feminist digital rights, and the need for inclusive tech design.

https://parentesislegal.com/barbara-espinosa-lizcano/

https://parentesislegal.com/barbara-espinosa-lizcano/

https://parentesislegal.com/barbara-espinosa-lizcano/

• “Día Internacional de la Igualdad Salarial y la brecha salarial por IA”

• “Día Internacional de la Igualdad Salarial y la brecha salarial por IA”

• “Día Internacional de la Igualdad Salarial y la brecha salarial por IA”

An exploration of wage inequality in the age of AI and the structural biases embedded in automated systems.

An exploration of wage inequality in the age of AI and the structural biases embedded in automated systems.

An exploration of wage inequality in the age of AI and the structural biases embedded in automated systems.

• “Ofertas para el Buen Fin — No caigas en el capitalismo emocional”

• “Ofertas para el Buen Fin — No caigas en el capitalismo emocional”

• “Ofertas para el Buen Fin — No caigas en el capitalismo emocional”

A commentary analyzing how consumer-driven emotional capitalism disproportionately impacts women, pushing them toward harmful consumption as a supposed form of healing.

A commentary analyzing how consumer-driven emotional capitalism disproportionately impacts women, pushing them toward harmful consumption as a supposed form of healing.

A commentary analyzing how consumer-driven emotional capitalism disproportionately impacts women, pushing them toward harmful consumption as a supposed form of healing.

Speaking & Teaching

Speaking & Teaching

Speaking & Teaching

QUERIDO DINERO, S.A. DE C.V. FINANCIAL MENTORING PROGRAM

QUERIDO DINERO, S.A. DE C.V. FINANCIAL MENTORING PROGRAM

QUERIDO DINERO, S.A. DE C.V. FINANCIAL MENTORING PROGRAM

“Online laboral and financial Mentor for young adults.

“Online laboral and financial Mentor for young adults.

“Online laboral and financial Mentor for young adults.

VENTURE CAFÉ

VENTURE CAFÉ

VENTURE CAFÉ

Speaker

Speaker

Speaker

PRIVACY POLICY

PRIVACY POLICY

PRIVACY POLICY